Equity Metals Closes First Tranche of Private Placement

This news release is not intended for distribution to United States newswire services or dissemination in the United States.

Equity Metals Corporation (the “Company” or “Equity Metals”) reports today that it has closed the first tranche of the previously reported $6,000,000 non-brokered private placement by issuing 2,800,000 non-flow through units (“NFT units”) at a price of $0.14 per unit for gross proceeds of $392,000 and by issuing 7,903,667 flow-through units (“FT units”) at a price of $0.15 per unit for gross proceeds of $1,185,549.95. Each NFT Unit will be comprised of one non-flow-through common share and one-half (0.5) of one warrant. Each FT Unit will be comprised of one flow-through common share and one-half (0.5) of one non-flow through warrant. The warrants for all units will be the same with each whole warrant entitling the holder thereof to purchase one non-flow-through common share for a period of 2 years at a price of $0.20.

Securities issued pursuant to this tranche of the private placement include common shares, share purchase warrants and finder’s warrants issued as finder’s fees, all of which carry a legend restricting trading of the securities until March 13, 2022.

The gross proceeds received from the sale of the FT Units will be used for work programs on the Company’s Silver Queen, Au-Ag, exploration property, in British Columbia. The net proceeds received from the sale of the NFT Units will be used for general working capital.

The Company may pay finders’ fees comprised of cash and non-transferable warrants in connection with the Offering, subject to compliance with the policies of the TSX Venture Exchange. Completion of the Offering and the payment of any finders’ fees remain subject to the receipt of all necessary regulatory approvals, including the approval of the TSX Venture Exchange.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933 (the “1933 Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons (as defined in the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration is available.

About Silver Queen Project

The Silver Queen Project is a premier gold-silver property with over 100 years of historic exploration and development and is located adjacent to power, roads and rail with significant mining infrastructure that was developed under previous operators Bradina JV (Bralorne Mines) and Houston Metals Corp. (a Hunt Brothers company). The property contains an historic decline into the No. 3 Vein, camp infrastructure, and a maintained Tailings Facility.

The Silver Queen Property consists of 45 mineral claims, 17 crown grants, and two surface crown grants totalling 18,852ha with no underlying royalties. Mineralization is hosted by a series of epithermal veins distributed over a 6 sq km area. Most of the existing resource is hosted by the No. 3 Vein, which is traced by drilling for approximately 1.2km and to the southeast transitions into the NG-3 Vein close to the buried Itsit copper-molybdenum porphyry.

An initial NI43-101 Mineral Resource Estimate (see Note 1 below) was detailed in a News Release issued on July 16th, 2019, and using a CDN$100 NSR cut-off, reported a resource of:

- Indicated – 244,000ozs AuEq: 85,000ozs Au, 5.2Mozs Ag, 5Mlbs Cu, 17Mlbs Pb and 114Mlbs Zn; and

- Inferred – 193,000ozs AuEq: 64,000ozs Au, 4.7Mozs Ag, 5Mlbs Cu, 16Mlbs Pb and 92Mlbs Zn.

More than 20 different veins have been identified on the property, forming an extensive network of zoned Cretaceous- to Tertiary-age epithermal veins. The property remains largely under explored.

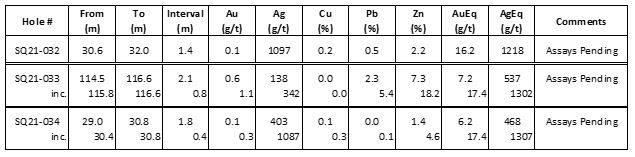

Table 1: Recently Reported Drill Intercepts from 2021 Drilling on the Camp Vein Target, Silver Queen Property, see NR-10-21.

Samples were analyzed by FA/AAS for gold and 48 element ICP-MS by MS Analytical, Langley, BC. Silver (>100ppm), copper, lead and zinc (>1%) overlimits assayed by ore grade ICP-ES analysis, High silver overlimits (>1000g/t Ag) and gold overlimits (>10g/t Au) re-assayed with FA-Grav. Silver >10,000g/t re-assayed by concentrate analysis, where a FA-Grav analysis is performed in triplicate and a weighed average reported. Composites calculated using a 80g/t AgEq (1g/t AuEq) cut-off and <20% internal dilution, except where noted. Reported intervals are core lengths, true widths undetermined or estimated. Accuracy of results is tested through the systematic inclusion of QA/QC standards, blanks and duplicates into the sample stream. AuEq and AgEq were calculated using prices of $1,500/oz Au, $20/oz Ag, $2.75/lb Cu, $1.00/lb Pb and $1.10/lb Zn. AuEq and AgEq calculations did not account for relative metallurgical recoveries of the metals.

About Equity Metals Corporation

Equity Metals Corporation is a Manex Resource Group Company. Manex provides exploration, administration, and corporate development services for Equity Metals’ two major mineral properties, the Silver Queen Au-Ag-Zn-Cu project, located in central B.C., and the Monument Diamond project, located in Lac De Gras, NWT.

The Company owns 100% interest, with no underlying royalty, in the Silver Queen project, located along the Skeena Arch in the Omineca Mining Division, British Columbia. The property hosts high-grade, precious- and base-metal veins related to a buried porphyry system, which has been only partially delineated. The Company also has a controlling JV interest in the Monument Diamond project, NWT, strategically located in the Lac De Gras district within 40 km of both the Ekati and Diavik diamond mines. The project owners are Equity Metals Corporation (57.49%), Chris and Jeanne Jennings (22.11%); and Archon Minerals Ltd. (20.4%). Equity Metals is the operator of the project.

The Company also has royalty and working interests in other Canadian properties, which are being evaluated further to determine their value to the Company.

1. The 2019 Silver Queen Resource Estimate was prepared following CIM definitions for classification of Mineral Resources and identified at a CDN$100/NSR cut-off, an indicated resource of 815Kt averaging 3.2g/t Au, 201g/t Ag, 1.0% Pb, 6.4% Zn and 0.26% Cu and an inferred resource of 801Kt averaging 2.5g/t Au, 184g/t Ag, 0.9% Pb, 5.2% Zn and 0.31% Cu. Grade capping on Ag and Zn was performed on 0.75m to 1.24m length composites. Au, Cu and Pb required no capping. ID3 was utilized for grade interpolation for Au and Ag while ID2 was utilized for Cu, Pb and Zn. Grade blocks were interpreted within constraining mineralized domains using and array of 3m x 1m x 3m blocks in the model. A bulk density of 3.56 t/m³ was used for all tonnage calculations. Approximate US$ two-year trailing average metal prices as follows were used: Au $1,300/oz, Ag $17/oz, Cu $3/lb, Pb $1.05/lb and Zn $1.35/lb with an exchange rate of US$0.77=C$1.00.

The C$100/tonne NSR cut-off grade value for the underground Mineral Resource was derived from mining costs of C$70/t, with process costs of C$20/t and G&A of C$10/t. Process recoveries used were Au 79%, Ag 80%, Cu 81%, Pb 75% and Zn 94%. AuEq and AgEq are based on the formula: NSR (CDN) = (Cu% * $57.58) + (Pb% * $19.16) + (Zn% * $30.88) +(Au g/t * $39.40) + (Ag g/t * $0.44) - $78.76.

Mineral Resources are not Mineral Reserves, do not have demonstrated economic viability and may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. Inferred Mineral Resources have a lower level of confidence than Indicated Mineral Resources and may not be converted to a Mineral Reserve but may be upgraded to an Indicated Mineral Resource with continued exploration. The Mineral Resources were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines.

The Mineral Resource Estimate was prepared by Eugene Puritch, P.Eng., FEC, CET and Yungang Wu, P.Geo., of P&E Mining Consultants Inc. (“P&E”) of Brampton, Ontario, Independent Qualified Persons (“QP”), as defined by National Instrument 43-101. P&E Mining suggests that an underground mining scenario is appropriate for the project at this stage and has recommended a CDN$100/tonne NSR cut-off value for the base-case resource estimate.

Robert Macdonald, MSc. P.Geo, is VP Exploration of Equity Metals Corporation and a Qualified Person as defined by National Instrument 43-101. He is responsible for the supervision of the exploration on the Silver Queen project and for the preparation of the technical information in this disclosure.

On behalf of the Board of Directors

“Joseph Anthony Kizis, Jr.”

Joseph Anthony Kizis, Jr., P.Geo

President, Director, Equity Metals Corporation

For further information, visit the website at https://www.equitymetalscorporation.com ; or contact us at 604.641.2759 or by email at ir@mnxltd.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. Factors that could cause actual results to differ materially from those in forward looking statements include the timing and receipt of government and regulatory approvals, and continued availability of capital and financing and general economic, market or business conditions. Equity Metals Corporation does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by applicable law.