Introduction

The WO Project is an advanced exploration diamond project where several diamondiferous kimberlites have been discovered. It is a joint venture, majority owned by De Beers Canada Inc. who is the operator of the project. The project contains an Indicated NI 43-101 resource of 19.5Mt at a grade of 0.94cpt for a total of 18.2 million carats of diamonds. For detailed resource parameters, see the section “Mineral Resource Estimates” Bulk sampling in 2007 produced rough diamonds up to 9.45 carats in size. The majority of the information in the following sections has been taken directly from the Peregrine Diamonds technical reports filed on SEDAR dated 15th July, 2014 and January 9th, 2009.

Property Description and Location

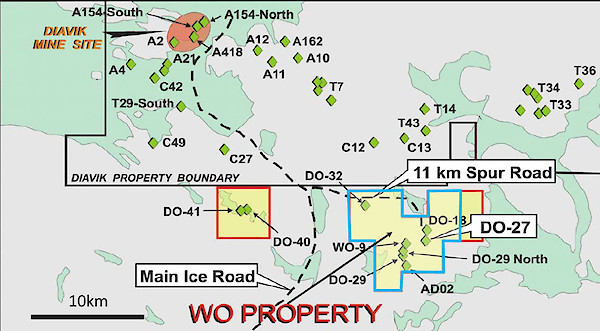

The WO Project is located in the Lac de Gras area, approximately 300 km north-northeast of the city of Yellowknife in the Northwest Territories, Canada to the southeast of the Diavik diamond mine centred at approximately 64o 20’ N latitude and 109o 50’ W longitude

The property consists of 8 leases for a total of 5,816.55ha which are owned by De Beers Canada Inc. (after takeover of Peregrine Diamonds Ltd.), (72.13%), Archon Minerals Limited (17.57%) and DHK Diamonds Inc. (10.30%). EQTY has a 43.37% interest in DHK Diamonds Inc. Royalties payable of 0.25% gross overriding royalty (GOR) to Mantle Diamonds Canada Inc.; 0.55% GOR to Aberex Minerals Ltd.; 1.0% GOR to 824567 Canada Limited - De Beers (Peregrine) holds 97.92% of the diamond marketing rights from any WO Property diamond production and is the operator of the Joint Venture.

Figure 1 - Location of WO Diamond Property (blue outline) with respect to Diavik Diamond Mine (Modified from Peregrine Diamonds January 2009 Technical Report to reflect updated WO Property)

Access and Infrastructure

Access to the area is from Yellowknife, which is the main staging area for all operations in this region. Most necessary services can be obtained in Yellowknife. Access is commonly via fixed wing aircraft equipped with wheels, floats, or skis, depending on the season. From approximately mid-January to mid-April access is provided via a winter ice road which connects Yellowknife with the Diavik and Ekati Diamond Mines. This road passes within 11 km of the DO-27 kimberlite.

History

Claims comprising the Project were originally part of the WO claim block staked by representatives of DHK consortium in February of 1992 following the announcement, by BHP Billiton (BHPB) and DiaMet Minerals Ltd. (Diamet), in the fall of 1991, of the diamond discovery at Point Lake. DHK shareholders were Dentonia Resources Ltd (Dentonia, 33%), Horseshoe Gold Ltd. (Horseshoe Gold, 33%) and Kettle River Resources (Kettle River, 33%). The claims were then optioned to Kennecott Canada Exploration Inc. (Kennecott), SouthernEra Resources Ltd (SouthernEra), and Aber Resources Inc. (Aber), who exercised the option, leaving DHK with a carried interest. Kennecott was operator and completed exploration work on the property discovering six kimberlites: DO-18, DO-27, DO-29N, DO-29S, DO-32 & AD-02 (Doyle, 1994; 1995; 1996; 1997). Between 2000 and 2004, some of the original claims were allowed to lapse and were acquired by other operators, including Thelon Ventures Ltd. (Thelon) and Dunsmuir Ventures Ltd. (Dunsmuir). In 2004, Peregrine acquired BHPB’s interest in the remaining claims from the original WO block (which contained the OW 19, OW 20 and TT 1 to 3 claims and SAS 1 to 3 leases). Dunsmuir entered into options to earn 100% interest in the MLT 1 to 6 and MLT 8 claims from a private prospecting syndicate and to earn a 65% interest in the CRW 5, and OKI 1 to 3 claims from Thelon. In 2006, Dunsmuir and Peregrine merged and the claims were re-united. In 2000, BHPB signed an option to earn an interest in part of the Project area by flying a FalconTM gravity survey and drilling targets. Kennecott agreed to exchange their 40% working interest in the property for a 9.9% interest in DHK. In 2004, Peregrine acquired BHPB’s interest in the Project. Peregrine was bought out by De Beers in September of 2018.

Geological Setting and Mineralization

The Project lies within the Slave Structural Province of the Northwest Territories, northern Canada, which is an Archean segment of the North American Craton. The Slave Province is subdivided isotopically into an eastern and a western domain. Kimberlites intrude granites, supracrustal rocks and, in some cases, diabase dykes (Pell, 1995, 1997) in both the eastern and western domains of the Slave Province. To date, all economic and near economic kimberlites, including those at Ekati, Diavik, Snap Lake, Gahcho Kue, and Jericho are located in the eastern Slave Province. Subsequent to kimberlite emplacement, the area was covered by the Laurentide ice sheet during the Late Wisconsinan glaciation, which climaxed about 20,000 years before present (B.P.). Till is the most prominent surficial sediment type in the Slave Geological Province. Glaciofluvial deposits, eskers, and outwash plains, are present in the Slave Province. In the Lac de Gras area, eskers are mainly west and northwest trending.

Two-mica post-deformational granite is the only major rock type on the properties. Medium- and high-grade Archean metaturbidites occur both east and west of the property. All of the kimberlites discovered on the properties, including DO-27 and DO- 18, which lies 800 m north of DO-27, intrude the granite. DO-27 does not crop out; it is overlain by 23-50 metres of till consisting of angular granitic boulders, gravel, sand, silt and clay and is mostly covered by Tli Kwi Cho Lake with an average depth of approximately 4 m and area of 1 km2. Till thickness at DO-18 is between five and 20 metres.

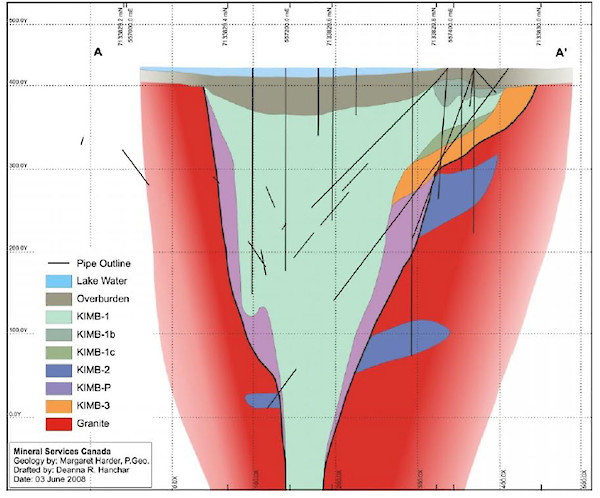

The main DO-27 pipe is asymmetrical in shape, with a steep western margin and a shallower eastern margin in the northeastern part of the pipe. The irregular shape of the pipe and complex geology in the northeastern zone suggests that two separate, but related eruptions may have been involved in pipe formation (Doyle et al., 1999). DO-27 consists primarily of KIMB-1, a pyroclastic kimberlite (PK). KIMB-1 is commonly light to medium green in colour. It is extremely altered and the upper 100 m generally displays extremely poor mineral and textural preservation. This lack of preservation is most notable towards the centre of the pipe, with preservation improving towards the margins. KIMB-1 is clast-supported, moderately well-packed, and is dominated by single olivine grains over juvenile lapilli, comprising approximately 60-70% olivine. KIMB-2 is volumetrically the second most important kimberlite. KIMB-2 is interpreted to be magmatic in origin and may be related to the magmatic sheets (dikes and sills) common immediately north of the DO-27 pipe. KIMB-2, where intersected in the vicinity of the northeastern lobe, is granite-rich (>25%), with a brownish to greenish kimberlite matrix with white to light green altered granitic clasts.

KIMB-3 is a complex unit of volcaniclastic kimberlite that contains several sub-divisions that cannot always be correlated between drill holes. To date, it has been observed only in the northeastern lobe of DO-27 where it comprises approximately 20% of the kimberlite (approximately 2% of the whole body), locally underlying KIMB-1. It is variable in colour from green to black and highly variable in grain size, sorting and xenolith content, with some units (KGB – kimberlite-granite breccia) containing > 30% granite boulders up to 2 m in size. KIMB-P is volcaniclastic, possibly re-sedimented, kimberlite infilling the DO-27 pipe which cannot be further subdivided into KIMB-1 or KIMB-3. It is present in small volumes at the pipe margins in many areas of the kimberlite. It contains variable amounts of dilution, and contains as much as 15% mud as xenoliths and within the matrix. Mineralization within the Project consists of kimberlite intrusions containing diamonds.

Figure 2 - Geological Cross-Section through the DO-27 Kimberlite Pipe

Exploration

Since the claims were first staked, exploration has consisted of geophysical studies, core and reverse circulation (RC) drilling, and underground developments. Peregrine exploration at DO-27 consists of core and large diameter reverse circulation drilling (LDD) in 2005, 2006, and 2007.

Mineral Processing and Metallurgical Testing

DO-27 Macrodiamond Sample Processing

Sample processing protocols were developed specifically for Peregrine’s requirements and the use of the Ekati sample plant. The Ekati sample plant was used by Peregrine for the 2005, 2006 and 2007 sample processing. AMEC visited the sample plant in 2005 to observe operations during DO-27 sample processing, and reported on their findings and recommendations (AMEC Americas, 2005). Howard Coopersmith was present at the Ekati plant for the processing of several complete DO-27 samples and audits, and to assess protocol compliance, metallurgical operations, efficiency, and security. A complete processing report was provided by BHPB (Fortin, 2007). The Ekati sample plant recovered diamonds down to a minus 1.0 mm bottom cut off, using primarily 1 mm x 14 mm slotted screens.

After the concentrate was produced, final diamond recovery operations were performed by Howard Coopersmith assisted by Jennifer Pell and Jim Crawford of Peregrine. Sorting procedures and protocols are presented in Appendix 5 of Coopersmith and Pell (2007). Ekati personnel performed all sample processing and recovery operations until the final product (X-ray diamond recovery machine and grease table products). These products were labelled and securely stored for Peregrine personnel who performed all final concentrate handling and sorting. Ekati personnel were not party to any final recovery operations or results; however, all operations were conducted in view of security cameras monitored by Ekati security personnel.

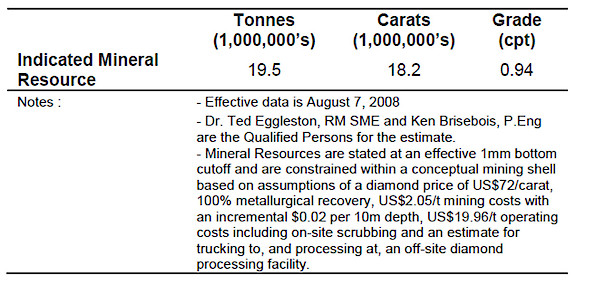

Mineral Resource Estimates

Table 1 contains the NI 43-101 mineral resource estimate on the property as of August 7, 2008. The tonnage reported in Table 1 lies within the Whittle™ resource shell and the modelled KIMB-1 boundary and is reported as undiluted kimberlite only (or partial block tonnes). The tabulation does not include mixed kimberlitic material that occurs between the KIMB-1 and KIMB-P boundary.

Table 1 - NI 43-101 Mineral Resource Estimate on the WO Diamond Property as of August 7th, 2008

AMEC identified an additional 6.5-8.5 Mt of material grading in the range of 0.8-1.0 cpt beneath the Indicated Mineral Resource that represents a target for additional exploration. The potential quantity and grade of the DO-27 target is conceptual in nature and there has been insufficient exploration to define a mineral resource. It is uncertain whether additional exploration will result in the target being delineated as a mineral resource.

The three-dimensional model of the DO-27 kimberlite and the tonnage and resource estimates are based on data from 66 core holes (17,300 m) and 46 LDD (35-61 cm) holes totalling 8,800 m and sample results for a cumulative 3,200 dry tonnes of bulk sample material collected from the LDD holes. The tonnage for each block was calculated by multiplying the interpreted volume by density determined from a three-dimensional density model developed by AMEC. The density model was based on 507 density measurements on drill core from throughout the body performed by Global Discovery Laboratories in Vancouver. Recovered macrodiamond results at a 1 mm lower cutoff were used to interpolate grades into 25 x 25 x 15 m blocks. Ordinary kriging was used to estimate the block grades. The Vulcan™ mine modelling software system was used to create the resource model.

Detailed analysis of diamond size distributions led to an adjustment process to account for known differences in diamond recovery regimes between drill campaigns. Study of these data showed that the distributions were affected by year-to-year treatment plant recovery differences. AMEC used factors derived from industry-standard recovery studies to adjust the distributions before their use in the resource estimation. Adjustments derived from these analyses for conversion of individual sample cpht values were 1.33 for 2007 data (addresses deficiency of small stones due to treatment plant differences) and 1.11 for 2006 data (adjusts for a small degree of deficiency of large stones).

AMEC used a base case from the various Lerchs-Grossman (LG) sensitivity runs to establish reasonable prospects for eventual economic extraction. The shell was used to restrict the estimated block model for tabulation and reporting. AMEC has used the Scrub-only, ‘high’ diamond price, LG case discussed below. This case uses the ‘high’ diamond value from the WWW International Diamond Consultants Ltd (WWW) diamond valuation. Based on project and resource modelling work to date, AMEC considers the kimberlitic material contained within the resulting resource shell to be an Indicated Mineral Resource (Table 1). The base elevation of the Indicated Mineral Resource lies within adequate proximity of the RC drilling where macrodiamond sampling has occurred. These data have been used to estimate and value the diamond resource. While the effective date of the estimation and tabulation is some six years older than this Technical Report, AMEC is of the opinion that diamond price escalation exceeds mining and operating cost escalation over the intervening time period. Application of escalated parameters would not result in a decreased resource shell. From this, AMEC concludes that DO-27 has reasonable prospects for eventual economic extraction.

Sampling issues with the RC drilling (refer Sections 13.4, 14.2.2) resulted in a resource model where local variations in block grades may not be fully reflected in the resource block estimates. The Indicated Mineral Resource classification must therefore carry the important caveat that it can only be converted to a Mineral Reserve without the use of cutoffs or mining selectivity assumptions. Any future Mineral Reserve conversion process must treat the Indicated Mineral Resource from this long range resource model as a bulk-mining target with no opportunity for selective mining alternatives.

There has been no Inferred Mineral Resource declared at this time given the results of the resource shell runs. It is clear from the resource shell results; however, that changing conditions may result in a declaration of an Inferred Mineral Resource in the future.

Reasonable Prospects for Eventual Economic Extraction

AMEC reviewed the technical and economic aspects of a conceptual mine on DO-27 as well as current diamond prices (WWW, 2014) and concluded that diamond price escalation likely more than offset any escalation of the assumed mining costs used in the resource estimates during the 2007-2014 period and that the Whittle™ resource shell used to constrain the Mineral Resource estimate in 2007 was still valid. The legal path forward for permitting of mines in the Northwest Territories is clearly defined. A number of mines have been successfully permitted in recent years. AMEC believes that there is a reasonable expectation that a mine could be permitted at DO-27.

Mineral tenure appears to be secure. Sufficient land for mining and infrastructure are available to support a mine on DO-27. Agreement with local First Nations will be required for surface use, but there is a reasonable expectation that those agreements can be reached. Local water resources are adequate to support mining but will require proper permits from local authorities. Based on the resource shell generated within Whittle™ and other factors discussed above, AMEC concludes that the DO-27 Resource has reasonable prospects for eventual economic extraction, but cautions that several factors could adversely impact that conclusion. Those factors include:

- Inability to secure mining permits.

- Inability to secure water rights.

- Significant decreases in diamond prices.

- Significant increases in operating or capital costs.

Other Relevant Data and Information – Diamond Valuation and Price Modelling

Peregrine contracted WWW to value the diamond parcels and perform price modelling.

WWW are recognized international leaders in this field. M.M. Oosterveld, a professional mining engineer and recognized expert in diamond evaluations was contracted to give an independent review.

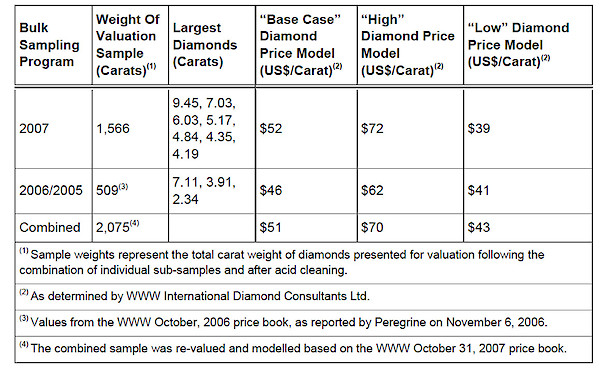

The 2007 individual sample goods were combined on the basis of geology to give four parcels for valuation: Parcels PDL07-03 and 04 from KIMB-1 in the main lobe of DO-27; Parcel PDL07-01 from KIMB-1 in the northeast lobe of DO-27; and Parcel PDL07-02 from other lithologies mixed with KIMB-1, at the base of the northeast lobe of DO-27. Results of the valuation are summarized in Table 1-2.

Table 2 - Summary of WWW Diamond Valuations for DO-27

WWW believes it is highly unlikely that the modelled average price will be lower than the minimum values and that the high values should not be considered maximum values. The modelled average price is extremely sensitive to the value of large diamonds so there is a high degree of uncertainty in the modelled value of the larger stones that would be expected in a production scenario.

AMEC was provided with a copy of a WWW report dated 14 July 2014 that shows changes to the diamond price index since the October 2007 DO-27 valuation. The WWW report shows a general upward trend to diamond prices since the valuation of the DO-27 diamond parcel.

AMEC relied on the WWW work to establish valuations for the diamonds. The valuations were applied to the estimated resource model grades models and became the basis for the development of LG resource shells within which resources have been declared. The valuation process performed by WWW and others is partially analytical (in the way that a gold assay process can be termed analytical) in that the diamonds are studied and classified. The dollar per carat determinations for various stones however, is ultimately governed by the valuators price-book. This part of the process is proprietary, governed by a given valuator’s view of the marketplace and can vary from valuator to valuator, particularly for larger stones. Even in larger parcels valuators must then ‘model’ or extrapolate values in the larger stone size classes where there may be few representatives. The methodology for modelling is also proprietary. The culmination of the process is the average prices for given zones, lobes or pipes. The heavy dependence of the process on economic market assessments, and the proprietary nature of the valuators assumptions and methods, materially affects the quality of, and confidence in, the mineral resource estimate. In this way, the valuations used in the resource assessments are quite different than the concept of analytical mineral assays in, for instance, a precious metal project. The proprietary nature of the processes employed for valuations limit any quantitative assessment of the added risk to the Project.

Conclusions

DO-27 is a diamondiferous kimberlite pipe in the Northwest Territories of Canada. It has been explored in detail to a depth of about 350 m by a combination of core and large diameter reverse circulation drilling. Drilling employed industry-standard procedures and protocols. Large diameter reverse circulation drilling was used to produce bulk samples that were then processed at the Ekati sample plant using standard procedures and protocols. Diamond valuation was performed by WWW and reviewed by M.M. Oosterveld, a recognized expert in diamond evaluations. AMEC has been involved with, and reviewed all aspects of the exploration and is of the opinion that it has been performed to industry standards. These data are the basis for an estimation of the mineral resource at DO-27. The DO-27 Mineral Resource estimates with an effective date of August 7, 2008 remain valid and relevant. Exploration discovered a number of other kimberlites that are diamondiferous. DO-18 was explored a number of core holes that outlined the shape of the kimberlite. Other kimberlites were drilled and sampled for microdiamonds. Additional work was not done on those kimberlites because the focus of the Project was DO-27 and later, other, higher priority Peregrine projects.