Equity Metals Provides Technical Update at Silver Queen Au-Ag Project; Adds Dr. Alan Wainwright to the Technical Team

Equity Metals Corporation (the “Company” or “Equity Metals”) reported today that it has initiated the 2020 work program at its Silver Queen Au-Ag project in British Columbia. Compilation and evaluation of existing data is ongoing by the Equity Metals’ technical team while awaiting permit approval for its 5-year, 50-site drilling program. Results to date have been very encouraging and provide a clear path to increase the current NI43-101 Mineral Resource Estimate on the property and to discover new deposits on the property through increased understanding of the larger, property-wide mineralizing system.

Initial exploration on the property will focus on the systematic resource expansion of known, open-ended mineralized zones within the historic high-grade epithermal vein system, as well as exploring for potential new mineral discoveries to further increase resources. Targeting to date has identified three separate veins for exploration drilling in 2020, with the near- to mid-term objective of doubling the existing mineral resource on the property by offsetting high-grade “ore-shoots” in the No. 3, Camp and NG-3 vein systems, followed by fast-tracking the expanded mineral resources into an economic study.

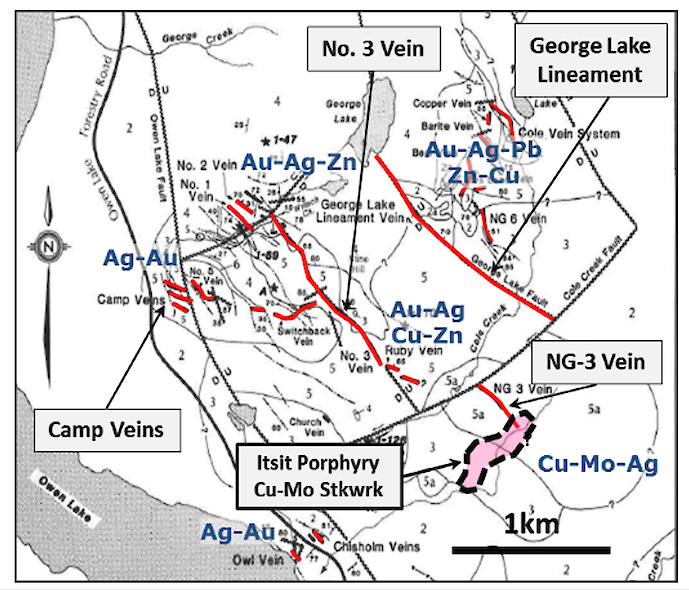

Currently, up to 20 separate veins and vein clusters are identified on the property with only the No. 3 Vein contributing significantly to the current Mineral Resource Estimate. Property-wide modelling has looked specifically at metal distribution and zoning, as well as precious-metal grades and grade thickness, and has identified the most gold/silver-enriched parts of the No. 3 Vein and the Camp Vein for immediate drill targeting. Further analysis has identified a clear zonation pattern that supports the concept of a genetic link between the high-grade epithermal veins and the adjacent Itsit Cu-Mo-Au porphyry, which is located southeast of the main veins and which was identified in 2011-18 drilling.

The Company also reports that Dr. Alan Wainwright, PhD Geology, has been added to the team to conduct studies in order to better understand controls of mineralization via detailed alteration studies and additional mapping. These studies should further refine several developing high-grade targets. Dr. Wainwright, a Research Associate with the Mineral Deposit Research Unit, UBC, is an expert in porphyry and vein mineralization, having worked extensively in porphyry belts in British Columbia, Mongolia, southwestern USA, eastern Europe, and elsewhere.

Silver Queen Technical Update

The Silver Queen Project features a high-grade Au-Ag-Zn mineral resource (see table below) that is accessed by road from the community of Houston, BC. Mineralization is hosted by a series of epithermal veins distributed over a 6 sq km area. The Itsit Cu-Mo-Au porphyry is blind at surface, but drilling has partially delineated it southeast of the main vein system. Most of the existing resource is hosted by the No. 3 Vein, which is traced by drilling for approximately 1.2km to the southeast where it transitions into the NG-3 Vein close to the Itsit porphyry.

Figure 1: The Silver Queen Vein System near Houston, British Columbia

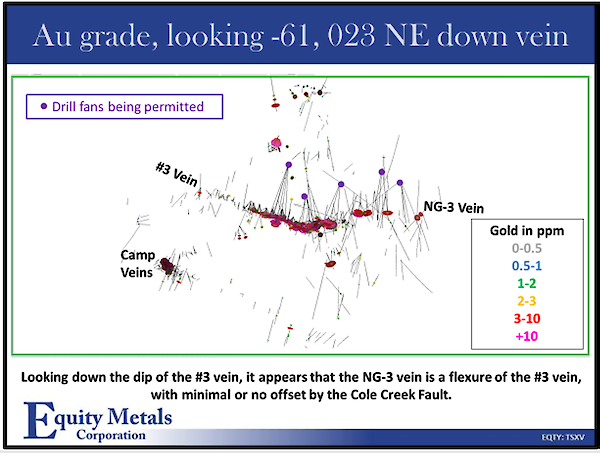

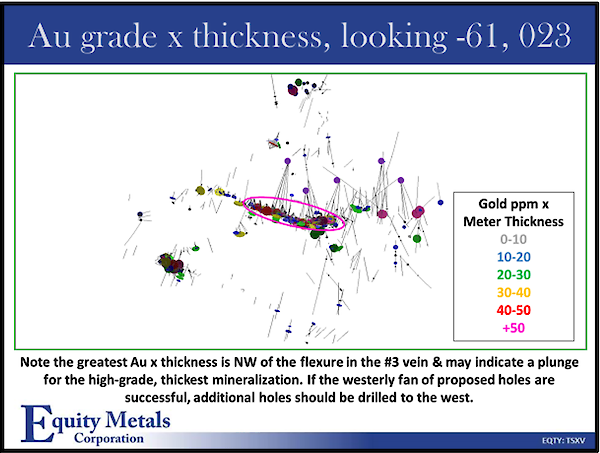

Recent 3D modelling of the No.3 Vein has clarified several important geologic features that increase the mineral potential at Silver Queen. Modelling has identified a flexure in the No. 3 Vein near the transition to the NG-3 Vein. The area of the flexure is characterized by an overall increase in the gold grade (see Figure 2) and increased gold grade x thickness (see Figure 3). The best zone occurs along a 600-metre strike length in the central part of the vein and adjacent to the flexure, which in vein systems often controls the locations of higher-grade ore zones. The flexure and the 600-metre, high-grade panel are the initial target areas for drilling. Other veins will be reassessed with this new structural understanding to identify new targets.

|

Figure 2: No. 3 & NG-3 vein exposure ~2.5km |

Figure 3: No. 3 & NG-3 vein Exposure ~2.5km |

|

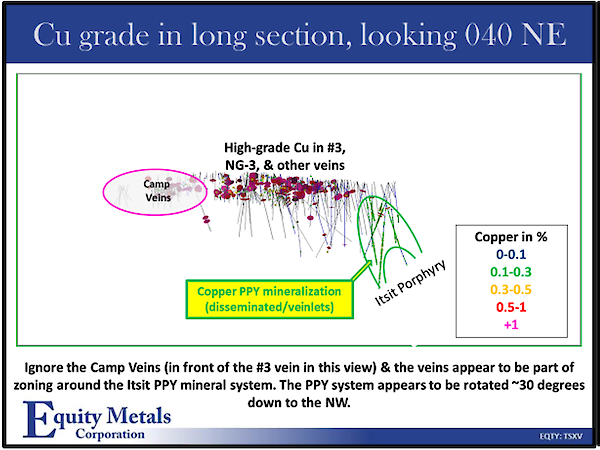

Figure 4: No. 3 & NG-3 vein exposure ~2.5km |

Figure 5: No. 3 & NG-3 vein Exposure ~2.5km |

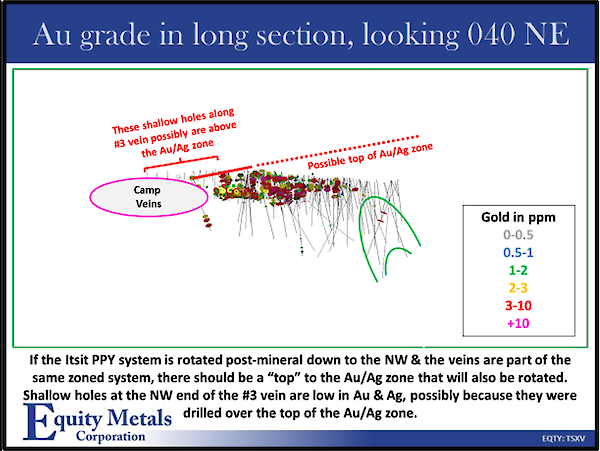

The long section view of copper (Figure 4) and gold (Figure 5) demonstrates the close association between the No. 3 Vein and the Itsit Cu-Mo-Au-Ag porphyry deposit. The location of the veins relative to the roughly defined porphyry mineralization suggests not only a genetic relationship within the larger (+6 square kilometre) mineralizing system but also significant telescoping of the system to over 500 metres depth, opening significant exploration potential beneath the current drill depth on the No. 3 Vein (typically no drilling below ~330 metres).

There is also a suggestion of tilting of the Itsit – Silver Queen system down to the NW, meaning at surface generally stronger Ag-enrichment in the northern and western parts of the vein exposures and stronger Au/Cu-enrichment in the southern and eastern exposures of the vein/porphyry system. Significantly, shallow holes on the NW end of the No. 3 Vein possibly drilled over the top of the strongest Au and Ag mineralization due to the rotation, indicating additional exploration potential at depth beneath the current level of drilling in that area.

Dr. Wainwright’s alteration study should assist in refining zoning patterns that will assist in locating favourable areas of high-grade shoots along the No 3 Vein and other veins.

Silver Queen Project Background

The Silver Queen Project is a premier gold-silver property with over 100 years of historic exploration and development and is adjacent to power, roads and rail with significant mining infrastructure that was developed under previous operators: Bradina JV (Bralorne Mines); and Houston Metals Corp. (a Hunt Brothers company). Included are an historic decline into the No. 3 Vein, camp infrastructure and a maintained Tailings Facility.

An initial NI43-101 Mineral Resource Estimate (see Note 1 below) was detailed in a News Release issued on July 16th, 2019, and using a CDN$100 NSR cut-off, returned:

- Indicated – 244,000ozs AuEq: 85,000ozs Au, 5.2Mozs Ag, 5Mlbs Cu, 17Mlbs Pb and 114Mlbs Zn; and

- Inferred – 193,000ozs AuEq: 64,000ozs Au, 4.7Mozs Ag, 5Mlbs Cu, 16Mlbs Pb and 819Mlbs Zn.

The resource is largely contained in the No. 3 Vein, which ranges in width from 0.5 to 4 meters. Over 20 different veins have been identified on the property, forming an extensive network of zoned, Cretaceous- to Tertiary-age epithermal veins. The property remains largely underexplored.

About Equity Metals Corporation

Equity Metals Corporation is a Manex Resource Group Company which provides exploration, administration, and corporate development services for Equity Metals’ two major mineral properties, the Silver Queen Au-Ag-Zn-Cu project, located in central B.C., and the Monument Diamond project, located in Lac De Gras, NWT.

The Company owns 100% interest, with no underlying royalty, in the 18,892ha Silver Queen project, located in the Omineca Mining Division, British Columbia. The property hosts high-grade, precious- and base-metal veins related to a buried porphyry system, which has been only partially delineated. The Company also has a JV interest in the Monument Diamond project, NWT, strategically located in the Lac De Gras district and occurs within 40 km of both the Ekati and Diavik diamond mines The project owners are Equity Metals Corporation (57.49%); Chris and Jeanne Jennings (22.11%); and Archon Minerals Ltd. (20.4%). Equity Metals is the operator of the project.

The Company also has royalty and working interests in other Canadian properties, which are being evaluated further to determine their value to the Company.

- The 2019 Silver Queen Resource Estimate was prepared following CIM definitions for classification of Mineral Resources and identified at a CDN$100/NSR cut-off, an indicated resource of 815Kt averaging 3.2g/t Au, 201g/t Ag, 1.0% Pb, 6.4% Zn and 0.26% Cu and an inferred resource of 801Kt averaging 2.5g/t Au, 184g/t Ag, 0.9% Pb, 5.2% Zn and 0.31% Cu. Grade capping on Ag and Zn was performed on 0.75m to 1.24m length composites. Au, Cu and Pb required no capping. ID3 was utilized for grade interpolation for Au and Ag while ID2 was utilized for Cu, Pb and Zn. Grade blocks were interpreted within constraining mineralized domains using and array of 3m x 1m x 3m blocks in the model. A bulk density of 3.56 t/m³ was used for all tonnage calculations. Approximate US$ two-year trailing average metal prices as follows were used: Au $1,300/oz, Ag $17/oz, Cu $3/lb, Pb $1.05/lb and Zn $1.35/lb with an exchange rate of US$0.77=C$1.00.

The C$100/tonne NSR cut-off grade value for the underground Mineral Resource was derived from mining costs of C$70/t, with process costs of C$20/t and G&A of C$10/t. Process recoveries used were Au 79%, Ag 80%, Cu 81%, Pb 75% and Zn 94%. AuEq and AgEq are based on the formula: NSR (CDN) = (Cu% * $57.58) + (Pb% * $19.16) + (Zn% * $30.88) +(Au g/t * $39.40) + (Ag g/t * $0.44) - $78.76.

Mineral Resources are not Mineral Reserves, do not have demonstrated economic viability and may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. Inferred Mineral Resources have a lower level of confidence than Indicated Mineral Resources and may not be converted to a Mineral Reserve but may be upgraded to an Indicated Mineral Resource with continued exploration. The Mineral Resources were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines.

The Mineral Resource Estimate was prepared by Eugene Puritch, P.Eng., FEC, CET and Yungang Wu, P.Geo., of P&E Mining Consultants Inc. (“P&E”) of Brampton, Ontario, Independent Qualified Persons (“QP”), as defined by National Instrument 43-101. P&E Mining suggests that an underground mining scenario is appropriate for the project at this stage and has recommended a CDN$100/tonne NSR cut-off value for the base-case resource estimate.

Robert Macdonald, MSc. P.Geo, is VP Exploration of Equity Metals Corporation and a Qualified Person as defined by National Instrument 43-101. He is responsible for the supervision of the exploration on the Silver Queen project and for the preparation of the technical information in this disclosure.

On behalf of the Board of Directors

“Joseph Anthony Kizis, Jr.”

Joseph Anthony Kizis, Jr. P.Geo

President, Director, Equity Metals Corporation

For further information, visit the website at www.equitymetalscorporation.com; or contact us at 604.641.2759 or by email at ir@mnxltd.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. Factors that could cause actual results to differ materially from those in forward looking statements include the timing and receipt of government and regulatory approvals, and continued availability of capital and financing and general economic, market or business conditions. Equity Metals Corporation does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by applicable law.