Equity Metals Receives Five-year Exploration Permit and Prepares to Drill the Silver Queen Au-Ag Project, British Columbia

Equity Metals Corporation (the “Company” or “Equity Metals”) reported today receipt of a five-year, area-based exploration permit for its 100% owned Silver Queen Au-Ag Project, located near Houston in the well-mineralized Skeena Arch region of British Columbia. Initial drilling on the property will focus on the systematic resource expansion on an historic high-grade precious-metal-enriched epithermal vein system as well as the identification of new mineral discoveries to further increase existing mineral resources noted below. Three separate vein structures are targeted for exploration drilling in 2020, with the near- to mid-term objective of doubling the existing mineral resource on the property.

The permit allows for drilling exploration from 50 drill sites throughout the property and the construction of up to 6 kilometres of additional exploration trails. All sites will be accessed from a year-round camp located on the Company’s fee-simple land at the Silver Queen mine site, which is located only 40km south of Houston, British Columbia via the all-season Morice-Owen forest service road.

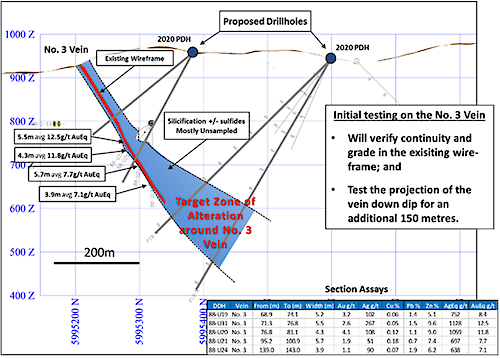

An initial exploration program of consisting of: i) drilling up to 3000 metres in up to 20 core holes to target the No. 3 Vein and Camp Vein; ii) verification of select historical drill intercepts; iii) completion of sampling through the entirety of the alteration halos surrounding the high-grade veins in order to evaluate potential mineralization in the halo; and iv) step-out drilling down dip and along strike to extend mineralization. Other work on the property will include surface mapping, property-wide prospecting, alteration studies and re-logging of historical drill core.

An initial NI43-101 Mineral Resource Estimate (see Note 1 below) was detailed in a News Release issued on July 16th, 2019, and using a CDN$100 NSR cut-off, reported a resource of:

- Indicated – 244,000ozs AuEq: 85,000ozs Au, 5.2Mozs Ag, 5Mlbs Cu, 17Mlbs Pb and 114Mlbs Zn; and

- Inferred – 193,000ozs AuEq: 64,000ozs Au, 4.7Mozs Ag, 5Mlbs Cu, 16Mlbs Pb and 819Mlbs Zn.

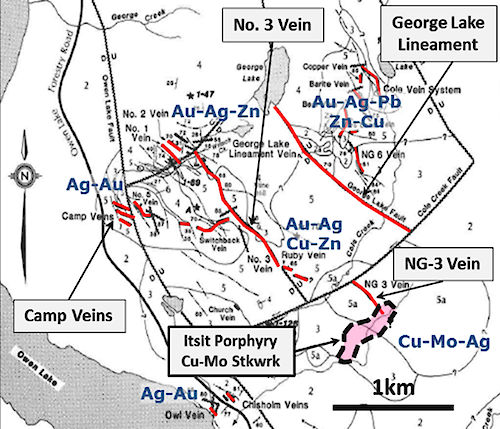

Over 20 different veins have been identified on the property, forming an extensive network of zoned, Cretaceous- to Tertiary-age epithermal veins. The resource is largely contained in the No. 3 Vein, which ranges in width from 0.5 to 4 meters.

Vice President of Exploration, Rob Macdonald commented, “The property remains largely underexplored with known mineralization being open at depth and along strike. The majority of the veins are poorly exposed at surface and have received little or no drill testing. Studies underway to more fully understand the structure, geochemical zoning, and alteration patterns should result in cost-effective exploration for extensions of known mineralization and for discovery of new, blind mineralization.”

Figure 1: The Silver Queen Vein System near Houston, British Columbia

Targeting on the No. 3 Vein

The No. 3 Vein is traced by drilling for approximately 1.2km where it transitions into the NG-3 Vein to the southeast, close to the Itsit porphyry area. Mineralization was discovered at the Silver Queen in 1912 and the No. 3 Vein was mined intermittently by separate owners in the early 1900s and again in the 1970s. Over 9000 metres of underground workings have been developed on the vein including a 900 metre decline, developed in the late 1980’s to access high-grade mineralization in the No. 3 Vein. The historic workings are currently flooded and can be easily rehabilitated.

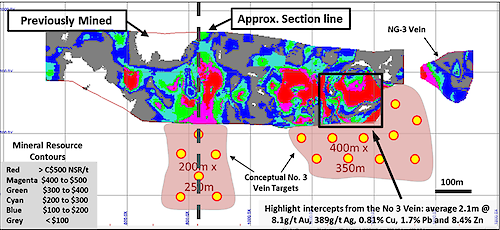

Figure 2: Colour-contoured longitudinal section of the No. 3 Vein looking east showing down-dip targeting

Mineral intercepts from 194 drill holes were used to construct the current resource model for the No. 3 Vein, which has been delineated by drilling to approximately 330 metres depth. Recent 3D modelling has identified a 600-metre strike length within the central part of the vein which is associated with both higher gold grade and vein thickness (see Figure 2). The central panel is adjacent to a major flexure in the vein, which in many vein systems can be a locus for higher grade shoots of mineralization. Two large target areas, measuring 200m x 250m and 400m x 350m respectively, occur down-dip of these modelled high-grade zones and form the primary target areas for the planned near- to mid-term resource expansion on the property.

Initial testing of the No. 3 Vein will verify the continuity and grade of mineralization within the existing wire-frame with particular attention to the mineralized alteration halo around the No. 3 Vein, which historically, was not entirely assayed. Drilling will also test the potential for additional veins in the footwall and hangingwall of the No. 3 Vein and will test the down dip projection of the No. 3 vein for an additional 150 metres.

Figure 3: Cross section through the No. 3 Vein showing high-grade mineralization within the existing wire frame, the locally extensive alteration halo surrounding the vein and the down-dip projection of the No. 3 Vein to be tested in 2020. Highlighted mineral intercepts are reported as down-hole thickness.

Targeting on the Camp Vein

The Camp Vein system is a blind set of four or more traceable veins located about 350 metres to the west of the No. 3 Vein. The veins were discovered by drilling in the late 1980’s. Over 50 core holes have tested and defined the Camp Vein system to date.

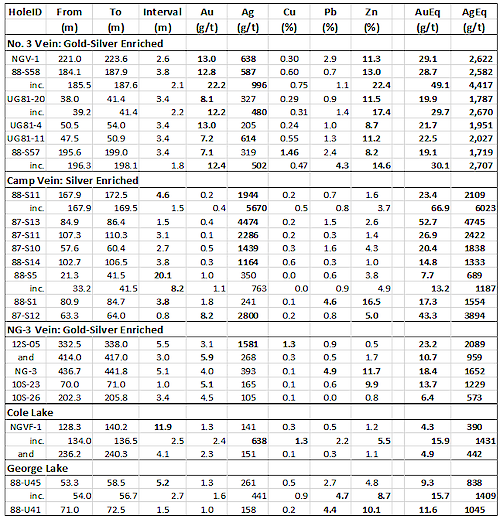

Mineralization in the Camp Vein system has returned some of the highest silver grades on the property, including highlight drill intervals (reported as down hole intercepts) of:

- 4.6m avg 1944g/t Ag, 0.7% Pb and 1.6% Zn from hole 88-S11;

- 1.5m avg 4474g/t Ag, 1.5% Pb and 2.6% Zn from hole 87-S13; and

- 3.1m avg 2286g/t Ag, 0.3% Pb and 1.4% Zn from hole 87-S11

High-grade silver mineralization occurs with pyrargyrite (“ruby silver”) in low sulphide veins and in association locally with massive sphalerite and galena.

Former owners in the 1990s identified a “drill-inferred reserve” in the Camp Vein of 204,092 tonnes of 1g/t Au, 829g/t Ag and 4% Zn2 which although not yet verified by the Company, forms the basis for definition of new targets in the upcoming exploration program. Current 3D modelling of the Camp Vein has identified four different veins, traced laterally for over 300 metres and projected to over 300 metres depth, representing a target area of approximately twice that tested by historical drilling. Initial testing of the Camp Vein will focus on confirmation of earlier drill results and down-dip step-outs of high-grade, strongly silver-enriched historical drill intercepts.

The reader is cautioned that the historical “drill-inferred reserve” estimate is being treated as historical in nature. A Qualified Person has not completed sufficient work to classify the historical estimate as a current mineral resource or reserve, and the Company is not treating the historical estimate as a current mineral resource or reserve.

No Mineral Resources for the Camp Vein were included in the current NI43-101 Mineral Resource Estimate.

Table 1: Select Historical Drill Intercepts from the No. 3, Camp, NG-3, Cole and George Lake veins on the Silver Queen Property.

Silver Queen Project Background

The Silver Queen Project is a premier gold-silver property with over 100 years of historic exploration and development located adjacent to power, roads and rail with significant mining infrastructure that was developed under previous operators: Bradina JV (Bralorne Mines); and Houston Metals Corp. (a Hunt Brothers company). The property contains an historic decline into the No. 3 Vein, camp infrastructure and a maintained Tailings Facility.

The Silver Queen Property consists of 45 mineral claims, 17 crown grants, and two surface crown grants totalling 18,852ha with no underlying royalties. Mineralization is hosted by a series of epithermal veins distributed over a 6 sq km area. Most of the existing resource is hosted by the No. 3 Vein, which is traced by drilling for approximately 1.2km to the southeast where it transitions into the NG-3 Vein close to the Itsit porphyry area. Over 20 different vein structures have been identified on the property, forming an extensive network of zoned Cretaceous- to Tertiary-age epithermal veins. The property remains largely under-explored.

About Equity Metals Corporation

Equity Metals Corporation is a Manex Resource Group Company which provides exploration, administration, and corporate development services for Equity Metals’ two major mineral properties, the Silver Queen Au-Ag-Zn-Cu project, located in central B.C., and the Monument Diamond project, located in Lac De Gras, NWT.

The Company owns 100% interest, with no underlying royalty, in the Silver Queen project, located along the Skeena Arch in the Omineca Mining Division, British Columbia. The property hosts high-grade, precious- and base-metal veins related to a buried porphyry system, which has been only partially delineated. The Company also has a controlling JV interest in the Monument Diamond project, NWT, strategically located in the Lac De Gras district within 40 km of both the Ekati and Diavik diamond mines The project owners are Equity Metals Corporation (57.49%), Chris and Jeanne Jennings (22.11%); and Archon Minerals Ltd. (20.4%). Equity Metals is the operator of the project.

The Company also has royalty and working interests in other Canadian properties, which are being evaluated further to determine their value to the Company.

- The 2019 Silver Queen Resource Estimate was prepared following CIM definitions for classification of Mineral Resources and identified at a CDN$100/NSR cut-off, an indicated resource of 815Kt averaging 3.2g/t Au, 201g/t Ag, 1.0% Pb, 6.4% Zn and 0.26% Cu and an inferred resource of 801Kt averaging 2.5g/t Au, 184g/t Ag, 0.9% Pb, 5.2% Zn and 0.31% Cu. Grade capping on Ag and Zn was performed on 0.75m to 1.24m length composites. Au, Cu and Pb required no capping. ID3 was utilized for grade interpolation for Au and Ag while ID2 was utilized for Cu, Pb and Zn. Grade blocks were interpreted within constraining mineralized domains using and array of 3m x 1m x 3m blocks in the model. A bulk density of 3.56 t/m³ was used for all tonnage calculations. Approximate US$ two-year trailing average metal prices as follows were used: Au $1,300/oz, Ag $17/oz, Cu $3/lb, Pb $1.05/lb and Zn $1.35/lb with an exchange rate of US$0.77=C$1.00.

The C$100/tonne NSR cut-off grade value for the underground Mineral Resource was derived from mining costs of C$70/t, with process costs of C$20/t and G&A of C$10/t. Process recoveries used were Au 79%, Ag 80%, Cu 81%, Pb 75% and Zn 94%. AuEq and AgEq are based on the formula: NSR (CDN) = (Cu% * $57.58) + (Pb% * $19.16) + (Zn% * $30.88) +(Au g/t * $39.40) + (Ag g/t * $0.44) - $78.76.

Mineral Resources are not Mineral Reserves, do not have demonstrated economic viability and may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. Inferred Mineral Resources have a lower level of confidence than Indicated Mineral Resources and may not be converted to a Mineral Reserve but may be upgraded to an Indicated Mineral Resource with continued exploration. The Mineral Resources were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines.

The Mineral Resource Estimate was prepared by Eugene Puritch, P.Eng., FEC, CET and Yungang Wu, P.Geo., of P&E Mining Consultants Inc. (“P&E”) of Brampton, Ontario, Independent Qualified Persons (“QP”), as defined by National Instrument 43-101. P&E Mining suggests that an underground mining scenario is appropriate for the project at this stage and has recommended a CDN$100/tonne NSR cut-off value for the base-case resource estimate. - George Cross News letter No.61 (1996). Resource is historic in nature and is provided by the company for information purposes only. It has not been verified by the company and should not be treated as a Mineral Resource Estimate.

Robert Macdonald, MSc. P.Geo, is VP Exploration of Equity Metals Corporation and a Qualified Person as defined by National Instrument 43-101. He is responsible for the supervision of the exploration on the Silver Queen project and for the preparation of the technical information in this disclosure.

On behalf of the Board of Directors

“Joseph Anthony Kizis, Jr.”

Joseph Anthony Kizis, Jr. P.Geo

President, Director, Equity Metals Corporation

For further information, visit the website at www.equitymetalscorporation.com; or contact us at 604.641.2759 or by email at ir@mnxltd.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. Factors that could cause actual results to differ materially from those in forward looking statements include the timing and receipt of government and regulatory approvals, and continued availability of capital and financing and general economic, market or business conditions. Equity Metals Corporation does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by applicable law.